- China is building more EVs than it can sell, leaving cars piling up and prices slashed.

- The combination of a price war, “zero-mile used cars” and lots full of new cars that nobody wants to buy shows a broken system.

- Many carmakers in China could die but are propped up by government subsidies, which require them to meet production quotas.

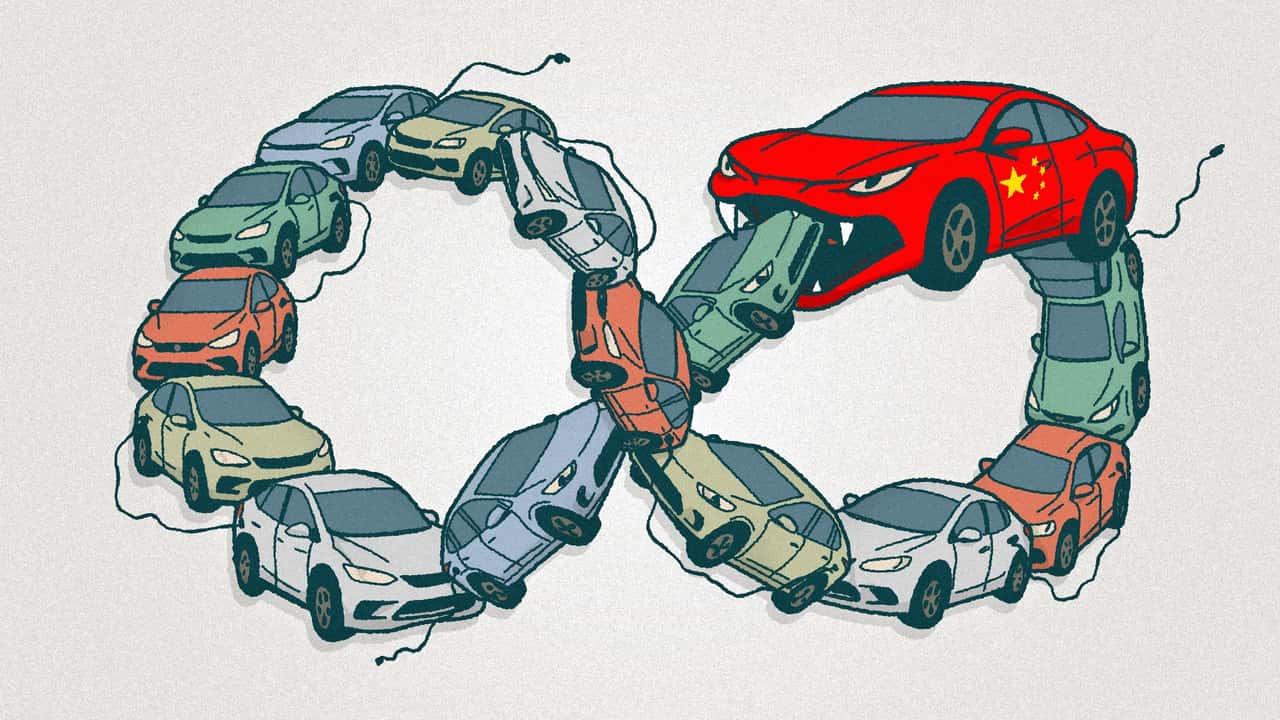

While China’s EV industry looks like an unstoppable and ever-growing juggernaut, there are deep issues bubbling below the surface. Sure, the country’s automakers are building a colossal number of very good and very well priced vehicles that are winning over buyers abroad. But these cars are also piling up at dealerships because of overproduction that far exceeds the real demand.

There definitely is appetite for EVs in China, but it’s nowhere near enough to find homes for all the cars being produced. As a result, some local manufacturers are bleeding cash and trying all sorts of shady tactics to get rid of their unsold inventory, like selling zero-mile used cars abroad or just letting them rot in mass car graveyards, Reuters highlighted in a deep-dive report on the issue.

The outlet found that you can buy a brand new locally-manufactured Audi vehicle for 50% off, or a car made by FAW for 60% off its intended list price. There’s a company called Zcar that’s buying these unsold cars in bulk and selling them at huge discounts. You can even buy brand new, heavily discounted cars in TikTok livestream fire sales in China, the outlet notes.

The bargain bin prices are a symptom of a much larger problem: After years of hefty government subsidies and ambitious production targets, Chinese companies now have the capacity to churn out double the 27.5 million cars they produced in 2024, according to a consulting firm cited by the outlet.

That, and the cutthroat competitive environment it’s created, has led to a brutal, years-long price war between manufacturers. Analysts project that only a fraction of China’s roughly 130 plug-in vehicle manufacturers from China will survive into the next decade, Reuters says.

Chinese officials are reluctant to car brands die en masse, though, the outlet explains. That is why the government continues to heavily subsidize production (which abroad is seen as unfair competition, hence the hefty import duties that Chinese EVs face in many places). It would mean lost jobs and it would make the country look bad on the global stage, where it’s trying to portray itself as both a production and an EV technology powerhouse. It is exactly that, although its EV industry may not be on as sure footing as most people think.

Even the biggest names like BYD also seem to be wobbling and it’s reportedly resorted to taking people who speak negatively about the brand to court. BYD lowered its sales projection for 2025 from 5.5 million vehicles to 4.6 million, and even that may be optimistic. Reuters noted in its very extensive investigation that it found 5,100 auction notices for brand-new BYD vehicles on Alibaba, all of which had been registered and insured, so they essentially counted as vehicles sold and delivered.

Because of the fierce competition back home, Chinese automakers are now, for the first time ever, spending more abroad than they do at home. Several big car brands from China are setting up production facilities in places like Europe, where they hope to build and sell cars while avoiding tariffs. BYD, China’s biggest EV maker, recently announced that its first European-built car will be the bargain-bin Dolphin Surf. It goes into production in Hungary later this year.

This idea of meeting often unrealistically large government-imposed production quotas regardless of whether there is or isn’t a market for all the products being made sounds all too familiar. Even if China tries to portray itself as a special kind of communist-capitalist hybrid that works so well it has succeeded in dominating the global market, this practice has nothing to do with capitalism. It’s also unsustainable long-term, bad for the economy and bad for the environment.

Officials may have finally realized the scale of the issue and are now calling for an end to the price wars and EV overinvestment. And yet, as Reuters reports, as recently as June one province offered up hundreds of millions of dollars over time to automakers who could ultimately boost the region’s annual EV and hybrid production by 1.5 million vehicles.

If things really are as bad as Reuters says, then something’s got to give—and soon.